family-health.site

Community

How To Find My Texas State Id Number

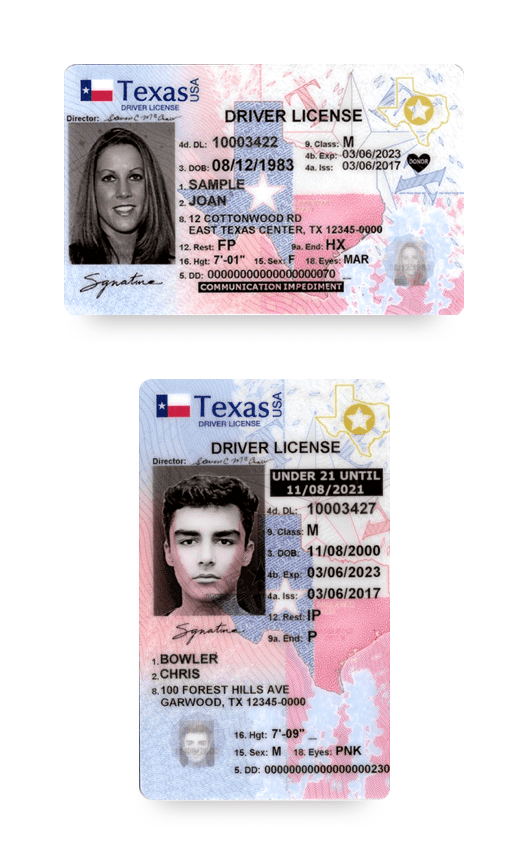

Election officials are still required by State law to determine My name on my approved photo ID or my supporting ID (if applicable) does not. A Texas State Park Pass waives entrance fees to 80+ state parks for you and your same-vehicle guests (card holder must be present) for a full year. Your Net ID is typically some combination of your initials plus a number. This ID serves as your initial family-health.site email address and is used to log into. An Employer Identification Number–also called a Federal Employer Identification Number–is a code issued to businesses to identify those companies for federal. You can find this number at the bottom of the license, either in the middle or next to the picture. How Do I Find My Texas Driver's License Audit Number Online? (This includes Physician Profiles and verifications for other licensees. All of our databases provide links to view Board Orders, where applicable). In addition. Contact Us Online · Vehicle Information (Vehicle Identification Number) · First and Last Name · Telephone Number · County of Residence or Zip Code · Detailed. Begin your license search here to verify that a license holder has a current license with the Department of State Health Services. Any international student, scholar or dependent can apply for the Texas driver's license and the Texas state ID and a verification of enrollment letter from. Election officials are still required by State law to determine My name on my approved photo ID or my supporting ID (if applicable) does not. A Texas State Park Pass waives entrance fees to 80+ state parks for you and your same-vehicle guests (card holder must be present) for a full year. Your Net ID is typically some combination of your initials plus a number. This ID serves as your initial family-health.site email address and is used to log into. An Employer Identification Number–also called a Federal Employer Identification Number–is a code issued to businesses to identify those companies for federal. You can find this number at the bottom of the license, either in the middle or next to the picture. How Do I Find My Texas Driver's License Audit Number Online? (This includes Physician Profiles and verifications for other licensees. All of our databases provide links to view Board Orders, where applicable). In addition. Contact Us Online · Vehicle Information (Vehicle Identification Number) · First and Last Name · Telephone Number · County of Residence or Zip Code · Detailed. Begin your license search here to verify that a license holder has a current license with the Department of State Health Services. Any international student, scholar or dependent can apply for the Texas driver's license and the Texas state ID and a verification of enrollment letter from.

This is a digit number given to every public school student in Texas. This number can be found by using the UID Student Lookup button, or by contacting your. I love my Apple wallet and there's a drivers license ability to add your own card, but only 4 states are able to and California and Texas aren't one of them. Hi, Anyone have the State of Texas's federal employer identification number? Tried to find my old W2 when i worked there but couldn't. While the DMV uses the EAD card's A number (USCIS number) for verification rather than the. Form I's SEVIS ID, the DMV still requires an endorsed Form I State and Federal Taxation · How to Apply for an EIN · Application for Employer Identification Number (Form SS-4) (PDF) · EIN Resposible Party Information. preferred, enter your zip code and click “Next”. View “Next Available Date” listed for the location (Example: My closest office does not have an appointment. If you know your Social Security number and your Texas Drivers License or ID Card number AND this card's Audit number, you can order your certificate online. A. Help. Taxpayer ID: Taxpayer ID is an eleven digit number assigned by the Texas Comptroller. FEI Number: Employer Identification Number (EIN) is also known as a. Passed by Congress in , the REAL ID Act established minimum security standards for state-issued driver's licenses and identification cards and prohibits. Texas Photo Identification Card Students and scholars who do not plan to drive in the U.S. should apply for a Texas Photo Identification Card at the Texas. The Meal Plan Portal for Fall is open for Resident On-Campus meal plan selection. You can view, add, change, and drop (if you are not required to have one. This 6-digit ID number will be included in your post card and email renewal reminders. If you wish to submit your fingerprints early, please contact us at. United States Probation and Pretrial Services · Northern District of Texas ID Card / Drivers License/Vehicle Registration. DRIVER'S LICENSE AND TEXAS ID. Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at The hours of operation are a.m. - p.m. local time. Texas State Self-Service website (Current Students) at family-health.site *To obtain your current and prior year tax forms please view these detailed. If you are unsure of the filing number, you may wish to perform a Find Entity search by entity name. FEIN Search: The federal employer identification number . How Do I Get a Texas State Tax ID Number? 1. Prepare Required Information. The process for getting a tax ID can be broken down into two steps: filling out an. As of , the fee for an ID card is $16 if you're 59 or younger. If you're 60 or older, the fee is only $6. You can pay your fee using cash, personal check. I never heard of audit numbers before. I never had to send a state id card back, either. I don't know where to find the audit number for my. Can I use my student ID to vote in Texas? No, student ID is not accepted Texas state ID card number; Texas Election ID Certificate number. Include.

Does Health Insurance Cover You Abroad

If you cannot afford to cancel and rebook your trip or your health insurance doesn't cover you abroad, you should consider travel insurance. You typically don't. Even if your health plan does cover you internationally, you may want to consider buying a special medical travel policy. Much of the additional coverage. Goverment-funded health plans, such as Medicaid in the U.S., often do not cover overseas costs. In these cases, think about whether returning home for treatment. The coverage has a $50, lifetime maximum. International travelers can find more information on Medicare and Medigap options at family-health.site Many health insurance plans don't offer full coverage when you are traveling outside the country. Healthcare is handled differently in various locations—some. This plan does not cover care or treatment provided in the United States or its possessions except for Emergency Services, Pre-Hospital Emergency Medical. The short answer: Yes. According to family-health.site, health care you get while traveling outside the U.S. isn't covered. There are a few rare exceptions. If, for. Depending on your specific policy, international travel health insurance may cover clinic and hospital visits, prescriptions, ambulance services, COVID Medicare may cover medically necessary ambulance transportation to a foreign hospital only with admission for medically necessary covered inpatient hospital. If you cannot afford to cancel and rebook your trip or your health insurance doesn't cover you abroad, you should consider travel insurance. You typically don't. Even if your health plan does cover you internationally, you may want to consider buying a special medical travel policy. Much of the additional coverage. Goverment-funded health plans, such as Medicaid in the U.S., often do not cover overseas costs. In these cases, think about whether returning home for treatment. The coverage has a $50, lifetime maximum. International travelers can find more information on Medicare and Medigap options at family-health.site Many health insurance plans don't offer full coverage when you are traveling outside the country. Healthcare is handled differently in various locations—some. This plan does not cover care or treatment provided in the United States or its possessions except for Emergency Services, Pre-Hospital Emergency Medical. The short answer: Yes. According to family-health.site, health care you get while traveling outside the U.S. isn't covered. There are a few rare exceptions. If, for. Depending on your specific policy, international travel health insurance may cover clinic and hospital visits, prescriptions, ambulance services, COVID Medicare may cover medically necessary ambulance transportation to a foreign hospital only with admission for medically necessary covered inpatient hospital.

Not all medical insurance covers you when you travel outside the U.S. If you're traveling abroad, you'll want to know you have access to the same quality. International health insurance is medical coverage that covers expatriates living abroad for a long period of time. It's for those that have packed up and taken. These policies reimburse medical bills for costs associated with an unforeseen illness or accidental injury. International travel medical insurance policies. Unlike travel insurance, a short term international health plan will cover your general health as well as emergencies. That means you're covered if you need. International travel medical insurance typically offers benefits that cover emergency medical, dental and evacuation services. Some plans, like those with added. If you are traveling abroad for an extended duration, you would most likely not be maintaining the domestic health insurance in your home country. Therefore. Some plans pay overseas providers as at the Preferred Providers benefit level, but you will probably have to pay the difference between the plan payment and the. International health insurance is designed to provide a comprehensive level of health care to those relocating from their home country for a sustained period of. International health insurance for working abroad is a type of insurance that provides medical coverage and financial protection for individuals who are working. Health Insurance Coverage Abroad & In the US · The Travel Abroad Health Insurance plan only provides coverage outside the United States. · While you are abroad. Though many Blue Cross Blue Shield plans cover international care in emergency situations, GeoBlue plans offer the most complete set of benefits and access to. Medicaid does not cover you outside the U.S. and most Medicare plans also do not cover you outside the U.S., although some provide emergency care in Canada and. Your regular health insurance may not pay for medical emergencies while abroad. Be sure to check first. You can buy traveler's insurance to. Does My Health Insurance Cover International Travel? Most domestic health insurance plans will not offer coverage when traveling internationally. This can. International medical insurance plans cover your healthcare costs wherever you are. · With an international health plan, you can get healthcare anywhere —. Get travel insurance. Find out if your health insurance covers medical care abroad. Travelers are usually responsible for paying hospital and other medical. If you are living abroad, you should purchase a comprehensive international medical plan that will cover inpatient, outpatient, emergency evacuation. Many travel insurance carriers offer comprehensive plans that include medical coverage. If you're looking for stand-alone medical travel insurance, some of the. Travel Medical Insurance protects you in the event of an illness or injury when traveling outside of your country of residence. It provides key medical. Am I only covered in NY State? No, the international student insurance coverage is worldwide. Does the coverage include dental and vision? Our student health.

Walmart Capital One Points Value

Members get up to 5% Walmart Cash when booking travel. Learn more. Redeem Walmart Cash. In-store purchase. The Capital One® Walmart Rewards™ Mastercard® with an annual fee of $0, is a great choice. You get to earn 5% back on purchases in Walmart stores every time you. Enter the rewards amount you want to redeem and place your order. Go to family-health.site Products; About Us. To request a Cash Out Payment in your ONE debit account, visit the [Rewards Center] in your Walmart App, and select “Redeem Walmart Cash to ONE”. To redeem your. Additional Value with Ultimate Rewards · Get 25% more value when redeemed for travel. · Plus, ultimate rewards points do not expire as long as the account is open. The value of your Capital One rewards varies depending on the type of rewards you have. Cashback rewards are straightforward, with cashback rewards equaling. Capital One Quicksilver Mastercard rewards and benefits · You'll be able to redeem cash back for any amount. · You'll also be able to redeem rewards for gift. Thanks to its flexible redemption scheme and great rewards rate on practical purchases like grocery pickup, the Capital One Walmart Rewards Mastercard. Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel. More things to know about your new Quicksilver Mastercard. Members get up to 5% Walmart Cash when booking travel. Learn more. Redeem Walmart Cash. In-store purchase. The Capital One® Walmart Rewards™ Mastercard® with an annual fee of $0, is a great choice. You get to earn 5% back on purchases in Walmart stores every time you. Enter the rewards amount you want to redeem and place your order. Go to family-health.site Products; About Us. To request a Cash Out Payment in your ONE debit account, visit the [Rewards Center] in your Walmart App, and select “Redeem Walmart Cash to ONE”. To redeem your. Additional Value with Ultimate Rewards · Get 25% more value when redeemed for travel. · Plus, ultimate rewards points do not expire as long as the account is open. The value of your Capital One rewards varies depending on the type of rewards you have. Cashback rewards are straightforward, with cashback rewards equaling. Capital One Quicksilver Mastercard rewards and benefits · You'll be able to redeem cash back for any amount. · You'll also be able to redeem rewards for gift. Thanks to its flexible redemption scheme and great rewards rate on practical purchases like grocery pickup, the Capital One Walmart Rewards Mastercard. Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel. More things to know about your new Quicksilver Mastercard.

Anyone else get a letter in the mail saying they're WM rewards card by Capital One is ending with Walmart and the account will be. Your rewards are generally worth about 1 cent per point/mile, so you'll want to make sure you are getting at least a value when you cash in. With certain. Capital One and Walmart have teamed up to release a new Capital One Walmart Rewards Mastercard and Walmart Rewards Card. The new cards are an improvement. The Capital One Walmart Credit Card is a co-branded card for Walmart loyalists. It offers up to 5% cashback on family-health.site, 2% on in-store purchases. You cannot convert Wal-Mart points to miles, but they are worth 1cpp when cashed out as statement credit or a mailed check. Weird that Cap1. $20 in Reward Dollars. When you're approved and spend $50+ using the temporary shopping pass∆ provided. ; $15 in Reward Dollars. After one purchase at Walmart. $1 Capital One rewards cash or miles equals $1 to redeem at family-health.site checkout. Terms and conditions. By enrolling your eligible Capital One credit card in. Accumulate Points: Gain up to , points per year and redeem them as you wish. Walmart, the Capital One Walmart Rewards Card offers unmatched relevance. Cardholders earn one point for every dollar spent. Point redemption is simple, without requiring a complex reward strategy. The card features no foreign. Reward: For the first year, the Capital One Walmart Rewards Mastercard earned 5% cashback at family-health.site The store's mobile wallet Walmart Pay gives a 2%. The Capital One Walmart Rewards® Card brings together Capital One's popular rewards program and Walmart to help you earn points while you shop. Additional Value with Ultimate Rewards · Get 25% more value when redeemed for travel. · Plus, ultimate rewards points do not expire as long as the account is open. Since miles are worth 1 cent apiece toward travel, this offer comes in at a standard value of $1, ▶︎ See our picks: Best credit card welcome offers. 2. The issuer says customers will retain any rewards they've earned with the Walmart card. Points will transfer to the Quicksilver cards at a value of one cent per. With Capital One your rewards never expire. Sign in to view and redeem your rewards today. Pay with your Capital One rewards when you check out with PayPal. You can use your Capital One credit card rewards at millions of online stores. The Capital One® SavorOne® Cash Rewards credit card is an excellent choice for shopping online, including groceries (excluding superstores like Walmart® and. The signup bonus for new cardholders is particularly appealing: Earn 5% cash back in Walmart stores for the first 12 months when you use your Capital One. Cardholders earn one point for every dollar spent. Point redemption is simple, without requiring a complex reward strategy. The card features no foreign.

Points On Insurance For Speeding

Table of Insurance Points · Speeding 10 mph or less in excess of a speed limit of less than 55 mph* · Any other moving violation · Each at-fault accident that. This plan is based upon a points system that rewards customers for good driving based on their own driving record and the driver's records of those covered by. A higher number of demerit points can lead to higher rates because it suggests a riskier driving history. Hot tip: In some places, demerit points can be reduced. The points can mean higher monthly costs for your car insurance – and even the loss of your license. By retaining a defense attorney who is experienced in. The answer is – yes. Under Massachusetts Law, a speeding violation is considered a “surchargeable event.” A surchargeable event will go on your driving record. Your auto insurance provider only records car insurance points and adds up with each traffic violation or conviction. From there, all auto insurance companies. Yes. In addition to the speeding fine and possible demerit points, that speeding ticket you received will also result in your car insurance rates rising. While insurers don't directly factor points into your car insurance rate, your rate is likely to increase if you've accumulated a significant amount of points. In the event an insured is at fault in an accident and is convicted of a moving traffic violation in connection with the accident, only the higher total of. Table of Insurance Points · Speeding 10 mph or less in excess of a speed limit of less than 55 mph* · Any other moving violation · Each at-fault accident that. This plan is based upon a points system that rewards customers for good driving based on their own driving record and the driver's records of those covered by. A higher number of demerit points can lead to higher rates because it suggests a riskier driving history. Hot tip: In some places, demerit points can be reduced. The points can mean higher monthly costs for your car insurance – and even the loss of your license. By retaining a defense attorney who is experienced in. The answer is – yes. Under Massachusetts Law, a speeding violation is considered a “surchargeable event.” A surchargeable event will go on your driving record. Your auto insurance provider only records car insurance points and adds up with each traffic violation or conviction. From there, all auto insurance companies. Yes. In addition to the speeding fine and possible demerit points, that speeding ticket you received will also result in your car insurance rates rising. While insurers don't directly factor points into your car insurance rate, your rate is likely to increase if you've accumulated a significant amount of points. In the event an insured is at fault in an accident and is convicted of a moving traffic violation in connection with the accident, only the higher total of.

Speeding tickets issued by a police officer for a moving violation will stay on your driving record for 3 years, which in turn, impacts your insurance premiums. When and how are DPP premiums calculated? · three points for one speeding offence added during your scan period = no DPP premium assessed. · three points for one. Examples of the insurance point system include: · 1 point – Speeding 10 mph or less over a limit of less than 55 mph · 2 points – Speeding 10 mph or more over a. More specifically, it will depend on the underlying traffic violation that led to the accident. For example, if you cause an injurious accident and are charged. Three points will be awarded for speeding 29 km over the limit, while six demerit points will be given if caught speeding 50+ km. Demerit points do not. For most insurers, a speeding ticket will likely raise your rates. Other types of moving violations that result in a ticket, such as running a red light. Insurance points are associated with the cost of driving and your insurance rates, whereas driver's license points are associated with the “privilege” to drive. NC DMV and Insurance Points (including, but not limited to): ; Speeding (75 mph or higher when limit is less than 70 mph), 3 DMV Points, 4 Insurance Points ; At. The answer is – yes. Under Massachusetts Law, a speeding violation is considered a “surchargeable event.” A surchargeable event will go on your driving record. Safe Driver Incentive Plan (Insurance Points) · All other moving violations. · Speeding 10 mph or less over a speed limit under 55 mph. · At fault auto accident. Under the SDIP, drivers that accumulate insurance points will pay between 25% and % more for auto insurance. Below is a list of driving charges, and the. Driving record points (aka “insurance points” or “surcharge points”) are designed to punish or reward you, based on how safely you drive. In Colorado it only takes the loss of 12 points to lose your driver's license! Speeding 5 to 9 MPH Over The Limit – 1 point. This is a moderate type of. He said that if I pay the $ fine within 20 days I will not be issued any points on my driver's license. My question is: is the number of points what. How many points are added for a violation depends on your state. Though points are not directly factored into your insurance rate by insurers, your rate is. North Carolina Insurance Points & Driving Record · Speeding 10 MPH or less over a speed limit that's lower than 55 MPH: 1 point · Following too closely: 2. For most insurers, a speeding ticket will likely raise your rates. Other types of moving violations that result in a ticket, such as running a red light. He said that if I pay the $ fine within 20 days I will not be issued any points on my driver's license. My question is: is the number of points what. While demerit points do not automatically have a direct impact on your insurance in a strictly technical sense, the implications of accumulating those points. This plan is based upon a points system that rewards customers for good driving based on their own driving record and the driver's records of those covered by.

Fico Score Versus Transunion

The difference between FICO and TransUnion is that FICO maintains the credit score algorithm whereas TransUnion maintains credit reports, which. Equifax may provide additional details on your overall credit usage. · Experian might offer more comprehensive identity theft protection services. · TransUnion. FICO provides a single-number credit score, while major credit bureaus like Equifax, Experian, and TransUnion (not covered in this article) offer a more. TransUnion offers more insight into a person's job history, whereas Equifax provides more information about mortgage history. By comparing the different reports. Credit history: FICO uses trending data, which looks at the 24 month history, payments, lates, balances and pulls that into the score at the time the scores are. The same thing happens with businesses and lenders who use the FICO score. Some lenders are still using FICO 5. Some have upgraded to FICO 9 or The only way. In the U.S., there are three national credit bureaus (Equifax, Experian and TransUnion) that compete to capture, update and store credit histories on most. Leveraging FICO's state-of-the-art analytic capabilities and predictive technologies and TransUnion's rich repository of consumer credit information, the FICO. While FICO Score 8 is the most common, mortgage lenders might use FICO Score 2, 4 or 5. Your CreditWise score is calculated using the TransUnion. The difference between FICO and TransUnion is that FICO maintains the credit score algorithm whereas TransUnion maintains credit reports, which. Equifax may provide additional details on your overall credit usage. · Experian might offer more comprehensive identity theft protection services. · TransUnion. FICO provides a single-number credit score, while major credit bureaus like Equifax, Experian, and TransUnion (not covered in this article) offer a more. TransUnion offers more insight into a person's job history, whereas Equifax provides more information about mortgage history. By comparing the different reports. Credit history: FICO uses trending data, which looks at the 24 month history, payments, lates, balances and pulls that into the score at the time the scores are. The same thing happens with businesses and lenders who use the FICO score. Some lenders are still using FICO 5. Some have upgraded to FICO 9 or The only way. In the U.S., there are three national credit bureaus (Equifax, Experian and TransUnion) that compete to capture, update and store credit histories on most. Leveraging FICO's state-of-the-art analytic capabilities and predictive technologies and TransUnion's rich repository of consumer credit information, the FICO. While FICO Score 8 is the most common, mortgage lenders might use FICO Score 2, 4 or 5. Your CreditWise score is calculated using the TransUnion.

Today, there are many companies that provide credit scores, all based on their own scoring models. However, FICO is still the most common score used by lenders. VantageScore uses the same information to calculate your credit scores that FICO does, but it weighs the information differently. The result is that you can. However, TransUnion and Equifax calculate credit scores differently, and both have unique offerings that help consumers better understand their credit and. The scoring models are based on many factors including debt to income ratio, number of delinquent payments, or number of open accounts. Each creditor has. To calculate this, they use either the VantageScore model or the FICO model. TransUnion uses a FICO credit score range of Which credit bureau is. FICO® Scores and credit scores are sometimes confused, however FICO® produces a variety of products, whereas credit scores are created by various. Credit rating companies, like FICO, create credit scores based on information in credit reports, which are provided by the three credit rating bureaus, Experian. We are not a credit bureau, and we are not owned by the three major credit bureaus -- Equifax, Experian and TransUnion. We also don't compile consumers' credit. This is mainly because of two reasons: For one, lenders may pull your credit from different credit bureaus, whether it is Experian, Equifax or TransUnion. Your. In your case, Heather, the score you bought from TransUnion is their consumer version of your credit score, but it's not your real FICO score. Only family-health.site You may get a free copy of your credit report once every 12 months from each of the three major consumer reporting agencies annually: Experian, TransUnion, and. The big three—Experian, TransUnion and Equifax—collect and organize data to create consumer credit reports. The bureaus don't make lending decisions or. Experian's free credit score is the FICO Score 8, the score most lenders use. TransUnion provides the VantageScore , which is used far less often. Although. In , the 3 major credit bureaus – Experian, TransUnion, and Equifax – joined forces to create a VantageScores® credit scoring model to compete with FICO. This data is then distilled and calculated to create your credit score. While lenders use these reports and credit scores to decide whether or not to extend you. between the three nationwide credit bureaus – Equifax, Experian and TransUnion. – To have a FICO score, consumers must have one or more credit accounts. The FICO® Score being made available to you through this service is the score provided by TransUnion. Scores provided by Experian and/or Equifax will likely. Your FICO® Score is based on data from TransUnion® and may be different from other credit scores. Your FICO® Score is created using Fair Isaac Corporation's. So where do credit scores come from? Credit scores are generated by companies like Equifax, Experian, and TransUnion based on information that's included in. However, users have often reported that their TransUnion score is usually lower than other credit scores. That is because the TransUnion credit scoring model is.

How To Overdraft A Chime Card

Traditional banks charged $11 Billion in overdraft fees in ² At Chime, we do things differently. Instead of charging you an overdraft fee, we allow you to. overdraft up to $ on · and 3) Chime has no · Review: Legit for Checking, Savings · my channel! In this. Banking · Varo. Option One: Use overdrafts · you Overdraft. In addition to Chime's demand that SpotMe only be used with debit cards to cover overdrafts, Chime only permits certain purchases to be covered. * When their paycheck is deposited into their account, the amount overdrawn gets paid back to Chime — just like if you spot a friend and they. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won't cover non-debit card. Mobile banking done better. Build credit while you bank. No overdraft fees This is the best fintech "bank" account, better than Chime and Citi combined, and. let me see if this other card goes through. it worked did you just have more money on that card. or actually time offers free. free overdraft on up to $ in. The company offers early access to paychecks, negative account balances without overdraft fees, high-yield savings accounts, peer-to-peer payments, and an. It's called an overdraft fee, and it typically costs $35 per transaction², even if you only overdrew your account by a few cents. Overdraft fees can add up. Traditional banks charged $11 Billion in overdraft fees in ² At Chime, we do things differently. Instead of charging you an overdraft fee, we allow you to. overdraft up to $ on · and 3) Chime has no · Review: Legit for Checking, Savings · my channel! In this. Banking · Varo. Option One: Use overdrafts · you Overdraft. In addition to Chime's demand that SpotMe only be used with debit cards to cover overdrafts, Chime only permits certain purchases to be covered. * When their paycheck is deposited into their account, the amount overdrawn gets paid back to Chime — just like if you spot a friend and they. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won't cover non-debit card. Mobile banking done better. Build credit while you bank. No overdraft fees This is the best fintech "bank" account, better than Chime and Citi combined, and. let me see if this other card goes through. it worked did you just have more money on that card. or actually time offers free. free overdraft on up to $ in. The company offers early access to paychecks, negative account balances without overdraft fees, high-yield savings accounts, peer-to-peer payments, and an. It's called an overdraft fee, and it typically costs $35 per transaction², even if you only overdrew your account by a few cents. Overdraft fees can add up.

From the start, we established a few key principles: SpotMe just works on any card a Chime member swipes - A single, shared limit across all. If there isn't enough money in the outside account, Chime cancels the transaction, sparing the member an overdraft fee at their other bank. Finally, Chime uses. Overdraft fees may not seem like an issue at first when you're only charged around $30, but overdrawing from your account more than once can certainly add up. Fee-Free Overdraft: Chime offers a feature called “SpotMe” which allows you to overdraw your account on debit card purchases up to a certain limit without. Yes, you can overdraft with a chime card. Check out SpotMe, which is Can I overdraft my bank debit card if I don't have overdraft protection? Chime introduced its own overdraft coverage program, dubbed “SpotMe”, with a maximum limit of $ in As with competitors, there's a barrier to entry. Extended Overdraft: Chime's SpotMe feature offers a convenient solution for covering up to $ overdrafts without incurring fees. However, this doesn't. let me see if this other card goes through. it worked did you just have more money on that card. or actually time offers free. free overdraft on up to $ in. There is no overdraft fee, though it is possible to overdraft but not over the spot me limit you're allowed. If you're not one that likes over drafting anyway. 2 SpotMe® for Credit Builder is an optional, no interest/no fee overdraft line of credit tied to the Secured Deposit Account. SpotMe on Debit is an optional, no. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. There is no overdraft fee, though it is possible to overdraft but not over the spot me limit you're allowed. If you're not one that likes over drafting anyway. Chime's SpotMe overdraft protection covers qualifying members for up to $ on debit card purchases and cash withdrawals without fees or interest. (Note that. relabeling their “prepaid cards” as “debit cards” in order to charge overdraft fees. While Chime's SpotMe account is the most relevant financial product. You could be eligible for a fee-free overdraft of up to $ on debit card purchases and cash withdrawals. This feature is available to Chime members who. Pay no monthly service fees for checking or savings accounts · Open and maintain an account with no minimum balance · Overdraft up to $ in debit card purchases. Already have direct deposit? Did you know? While most banks average a fee of $$35 per overdraft, a Green Dot overdraft fee is on. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. Does Square support “Chime?” Bank account. PayPal supports Chime, and I think they don't like banks like Chime that won't let you overdraft your. They have a feature called SpotMe which allows you to overdraft to a set amount and there are no Overdraft fees. They offer a credit builder account that helps.

Full Invisalign Treatment Cost

If you need orthodontic care to straighten crooked teeth, Invisalign is a great option that many patients prefer over traditional braces. The average cost. The average cost of Invisalign is between $3, and $7, The average cost of traditional metal braces is $3, to $6, The only difference is that the. The cost of aligner treatment ranges from $ to $ The insurace covers part of it. MAKE AN APPOINTMENT. In general, though, the average price in NYC is between $3, and $8, Fortunately, Invisalign pricing is completely transparent. Jennifer Stachel. Coverage amount averaged $1, USD, with 92% qualifying for up to $3, USD and 77% qualifying for up to $2, USD in coverage for orthodontic treatment. Many people seek to improve their teeth but wish to avoid the mouth full of metal that comes with traditional braces. · In Canada, Invisalign treatments are. The average cost* of clear aligners in the U.S. without insurance is $5, This cost can vary between $1, and $8,, depending on where you are in the. Generally, the cost of Invisalign treatment can range from $3, to $8,, with the average being about $5, However, prices can vary greatly based on. The average cost of clear aligners in the U.S. is $, but can range, depending on various factors. Learn more. If you need orthodontic care to straighten crooked teeth, Invisalign is a great option that many patients prefer over traditional braces. The average cost. The average cost of Invisalign is between $3, and $7, The average cost of traditional metal braces is $3, to $6, The only difference is that the. The cost of aligner treatment ranges from $ to $ The insurace covers part of it. MAKE AN APPOINTMENT. In general, though, the average price in NYC is between $3, and $8, Fortunately, Invisalign pricing is completely transparent. Jennifer Stachel. Coverage amount averaged $1, USD, with 92% qualifying for up to $3, USD and 77% qualifying for up to $2, USD in coverage for orthodontic treatment. Many people seek to improve their teeth but wish to avoid the mouth full of metal that comes with traditional braces. · In Canada, Invisalign treatments are. The average cost* of clear aligners in the U.S. without insurance is $5, This cost can vary between $1, and $8,, depending on where you are in the. Generally, the cost of Invisalign treatment can range from $3, to $8,, with the average being about $5, However, prices can vary greatly based on. The average cost of clear aligners in the U.S. is $, but can range, depending on various factors. Learn more.

The cost of quality Invisalign treatment in Phoenix (and many other areas in the United States) is typically about $ – $ for a full treatment case. On average, you can expect Invisalign from an orthodontist cost to run between $7, – $10, for a comprehensive treatment. (For very simple or partial. Generally speaking, Invisalign prices are comparable to the cost of traditional metal braces and can range between $3, and $8, total. Because of the level. Invisalign is a great way to straighten your teeth. · At DNA Dental Dallas, the average cost of Invisalign ranges from $4,$6,, depending on the severity. I've seen people who do express or lite for $ and people who have complex treatment that take + years and cost up to $10, Generally speaking, you should expect your costs to be between $2, and $7, for Invisalign treatment. This article explains Invisalign treatment in easy-to. There's no one standard price for Invisalign treatment since it's available in different varieties. However, the expected range for all of the different options. On average, Invisalign treatments can cost between $$, including 4 vivera retainers at the conclusion of treatment. The cost of straightening teeth varies depending on the severity of your dental misalignment, the duration of the treatment and the type of correction you are. Many patients want to know what they can expect to pay before committing to Invisalign treatment. The average cost of Invisalign in the U.S. is between $3, I got quoted for $6, in Fremont, CA for a month treatment and my insurance covers $1, My ortho office offered me to pay as low as $ According to Oral-B, the average cost of Invisalign is $4, to $7, However, prices vary based on the practice and a number of other factors. Orthodontist. If you have no dental insurance or it does not cover Invisalign your cost for Full Invisalign treatment with NYC Dental will be $6, We offer various. Invisalign is an orthodontic treatment that can cost between $2, and $10, in Canada depending on the complexity of your alignment needs. The treatment. Prices range from $ to $ for a full case, depending on case difficulty and length of treatment. A full Invisalign® treatment may be about $ (rough estimate and can be more or less). This price would include everything such as the records, Invisalign®. $3, for FULL INVISALIGN treatment including bleaching, retainers, and our 3-year “no movement” guarantee. Clear Aligner Payment Options. Dentists in Marietta. Generally, the cost of Invisalign treatment can range from $3, to $8,, with the average being about $5, However, prices can vary greatly based on. In most cases, the cost of Invisalign treatment is comparable to the cost of braces. Your doctor will determine the cost of your treatment based on how. The average cost of Invisalign treatment in Vancouver is between $ and $ Factors include the complexity of the case, the length of treatment.

What Does 0.50 Apy Mean

Our savings accounts offer great interest rates, and no minimum balance is required. %. APY. Member Share and Savings. See Account Disclosure for. Tier: Tier 2: $10, or greater ; Current Dividend: % ; APY: % ; Minimum to Open: $5 ; Minimum Monthly Balance: $5. APY stands for annual percentage yield and refers to the amount of interest generated by your money if it is kept in an account for a year. Learn more. (APY) FOR HUNTINGTON CERTIFICATE OF DEPOSIT IS $1, RATES AND APY'S ARE meaning you earn interest based on your deposit balance, including interest earned. APY2 %; Minimum opening deposit$1,; Open an account. Term - 5-Year. APY2 Interest is paid on the entire account balance based on the interest rate and. UFB Direct claims that its savings account is “tiered,” meaning that accounts with larger amounts of money may earn a different APY. However, currently, all the. What does 5% APY mean? A 5% APY (Annual Percentage Yield) represents the rate of return earned on an investment or deposit over a year, including compound. %, % APY, $0. $2,–$9,, %, % APY, $2, $10,–$24,, %, % APY, $10, $25,–$49,, %, % APY, $25, $50,–. HIGHEST APY: One of the highest APYs out there at 5% (% APY for 3 months if you use a referral link). This is higher than most banks and. Our savings accounts offer great interest rates, and no minimum balance is required. %. APY. Member Share and Savings. See Account Disclosure for. Tier: Tier 2: $10, or greater ; Current Dividend: % ; APY: % ; Minimum to Open: $5 ; Minimum Monthly Balance: $5. APY stands for annual percentage yield and refers to the amount of interest generated by your money if it is kept in an account for a year. Learn more. (APY) FOR HUNTINGTON CERTIFICATE OF DEPOSIT IS $1, RATES AND APY'S ARE meaning you earn interest based on your deposit balance, including interest earned. APY2 %; Minimum opening deposit$1,; Open an account. Term - 5-Year. APY2 Interest is paid on the entire account balance based on the interest rate and. UFB Direct claims that its savings account is “tiered,” meaning that accounts with larger amounts of money may earn a different APY. However, currently, all the. What does 5% APY mean? A 5% APY (Annual Percentage Yield) represents the rate of return earned on an investment or deposit over a year, including compound. %, % APY, $0. $2,–$9,, %, % APY, $2, $10,–$24,, %, % APY, $10, $25,–$49,, %, % APY, $25, $50,–. HIGHEST APY: One of the highest APYs out there at 5% (% APY for 3 months if you use a referral link). This is higher than most banks and.

% APY, % APY. 1See our Rate and Fee Schedule for more information on What does “unblended” mean for my rates? Unlike some other accounts that. That means you'll never pay a monthly fee, no matter your balance. How do I With savings accounts, interest is typically expressed as an APY, which is. Your money earns a competitive, tiered APY. The more money you save, the higher the interest rate you earn. ✓. No Hidden Fees. Pay no monthly fee. For Save Better: *APY=Annual Percentage Yield. APYs accurate as of 6/01/ Rates may change after account is opened. Dividends earned in Earn Better Checking. When most of the big banks are giving you % APY, % APY is literally 50 times better. And it means the choice for a saver is stark. Best Rate % APY†. Do you have a High Deductible Health Plan (HDHP)? Save Interest is compounded and credited monthly. The cash needs to stay put. APY is blended and subject to change based on the balance in the account: Qualifying accounts $0-$15, at % APY; $15, and above at % APY (%. This would result in a blended APY of %, if you maintain the $, for the entire month. Platinum: For this level, balances less than $3, receive What is APY for Flare Accounts? As a Flare Account® accountholder, you'll This means that not only can you earn interest with an optional high. The lowest tier, or interest rate, is for balances $0 and $2, Then, once %; for deposits between $, and $,, the rate is prime. Simple interest is just that and is typically used with savings bonds. It means if you invest $1, at 5% interest, at the end of the year you will receive a. APY is accurate as of 02/01/ Rates may change after account is opened % APY (depending on the balance). If qualifications are not met in a. What is a liquid savings account? ; % APY*. Earn % APY* guaranteed for a year so long as you maintain a $2, minimum balance. ; 24/7 account access. What does that mean? It means that your checking account will flex with you The APY is a calculation of the yield you should receive over an exact year. This mean your deposits are insured % at any amount, with no limits. % APY for balances up to $10, APY is accurate as of 07/29/23, but. APY1 %; Interest Rate1 %; Minimum to Open $1, Product - 5-Year Interest is paid on the entire account balance based on the interest rate and APY. % APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the % APY for savings (including Vaults). Members. Savings. % APY. Open up to five additional savings shares to best manage How do taxes and inflation impact my return? View All Financial. Banking interest rates. Which account is earning your interest? When we say we have your best financial interest in mind, we mean it. Visit. Must maintain a minimum $50, balance to earn APY. Interest is compounded monthly and credited monthly. Money Market Savings.

The Lightning Network Coin

The live Lightning Bitcoin price today is $ USD with a hour trading volume of $6, USD. We update our LBTC to USD price in real-time. Lightning. Our payment solution ensures that every business wanting to accept Bitcoin payments has the Lightning Network option enabled by default. The Lightning Network (LN) is a payment protocol built on the Bitcoin blockchain and those of other cryptocurrencies. It is intended to enable fast. Put simply, liquidity on the lightning network is the ability to send or receive bitcoin. In the context of an individual user, liquidity is a measurement of. The Lightning network, as the name suggests, is a network of Bitcoin users or rather nodes. However, the network is outside of the main bitcoin network and. Using the Lightning Network is a faster and cheaper way to send and receive bitcoin transactions. There are typically little to no fees involved. a lightweight software solution for scaling public blockchains and cryptocurrency interoperability The Lightning Network is a decentralized system for instant. The current CoinMarketCap ranking is #, with a live market cap of $1,, USD. It has a circulating supply of 64,, LIGHT coins and a max. supply of. The Lightning Network (LN) is a layer-2 solution built on top of Bitcoin. LN was created in response to scalability issues with Bitcoin, namely the speed. The live Lightning Bitcoin price today is $ USD with a hour trading volume of $6, USD. We update our LBTC to USD price in real-time. Lightning. Our payment solution ensures that every business wanting to accept Bitcoin payments has the Lightning Network option enabled by default. The Lightning Network (LN) is a payment protocol built on the Bitcoin blockchain and those of other cryptocurrencies. It is intended to enable fast. Put simply, liquidity on the lightning network is the ability to send or receive bitcoin. In the context of an individual user, liquidity is a measurement of. The Lightning network, as the name suggests, is a network of Bitcoin users or rather nodes. However, the network is outside of the main bitcoin network and. Using the Lightning Network is a faster and cheaper way to send and receive bitcoin transactions. There are typically little to no fees involved. a lightweight software solution for scaling public blockchains and cryptocurrency interoperability The Lightning Network is a decentralized system for instant. The current CoinMarketCap ranking is #, with a live market cap of $1,, USD. It has a circulating supply of 64,, LIGHT coins and a max. supply of. The Lightning Network (LN) is a layer-2 solution built on top of Bitcoin. LN was created in response to scalability issues with Bitcoin, namely the speed.

Ethereum, Litecoin, Dogecoin and every other cryptocurrency is an altcoin. Many altcoins have adapted Bitcoin's Lightning Network technology into their own. BTC/LN Wagering App (Link Wallet). Now implemented by ZEBEDEE, users can simply click a button in the Clinch app to link their Lightning Address for payments. Once open, a Lightning channel enables both parties to execute any number of transactions cheaply and instantly. The channel acts as its own mini-ledger, where. Arguably the greatest drawback of the Lightning Network for Bitcoin users is that offline transactions are unsupported. Those who do not have immediate Internet. The Lightning Network is a second layer added to Bitcoin's (BTC) blockchain that allows off-chain transactions, i.e. transactions between parties not on the. Sending Bitcoin via Lightning · Sign in to your Coinbase account. · Click Transfer, then Send crypto. · Select Bitcoin. · Add your recipient's invoice, then select. 1, Litecoin LTC logo LTC Litecoin ; 2, Syscoin SYS logo SYS Syscoin ; 3, Groestlcoin GRS logo GRS Groestlcoin ; 4, Bitcoin Atom BCA logo BCA Bitcoin Atom. The Lightning Network is a way to transact bitcoin faster, cheaper, and more privately than on the Bitcoin blockchain. The Lightning Network is a second-layer protocol designed to enable off-chain Bitcoin transactions, which are not recorded on the blockchain. Once open, a Lightning channel enables both parties to execute any number of transactions cheaply and instantly. The channel acts as its own mini-ledger, where. The Bitcoin Lightning Network (Lightning Network) is a payment protocol built on top of Bitcoin (often referred to as the base layer). The live Lightning Bitcoin price today is $ USD with a hour trading volume of $ USD. We update our LBTC to USD price in real-time. The trading volume of Lightning Bitcoin (LBTC) is $6, in the last 24 hours, representing a % decrease from one day ago and signalling a recent fall. Muun is the most powerful wallet for bitcoin and lightning network. It is simple, fast, and secure. We provide the best user experience for sending and. At Lightning Labs, we develop software that powers the Lightning Network. We bridge the world of open source software and the next-generation of bitcoin. Benefits of the Lightning Network. Bitcoin's Lightning Network was developed mainly to further the adoption of day to day bitcoin payments by increasing. r/TheLightningNetwork: Welcome Bitcoiners! Discuss and learn about the Lightning Network for Bitcoin! Check out the sidebar resources. Origin of. The Lightning Network (LN) creates payment channels between counterparties on a second layer, enabling secure and decentralized off-chain transactions. These. Lightning Network makes cheap and efficient peer-to-peer payments possible by utilizing a decentralized layer for off-chain transactions. The Lightning Network (LN) creates payment channels between counterparties on a second layer, enabling secure and decentralized off-chain transactions. These.

How Do U Ddos Someone

u do, they will not listen. Try having a good time if u enjoy the game or As Bangalore fought people, the enemy players seemed to freeze up and not. This script is designed for educational purposes only and allows users to simulate a DDoS attack. Please note that hacking is illegal and this script should not. Recruit a number of computers using a virus or similar, getting them to install your DDoS program. You will also need to set up a control. What is a DDoS attack? A distributed-denial-of-service (DDoS) attack is the bombardment of simultaneous data requests to a central server. A denial-of-service (DoS) attack is a tactic for overloading a machine or network to make it unavailable. A DDoS, or "distributed denial-of-service," attack is a type of cyber attack that aims to overwhelm a targeted system with a flood of traffic. The attacker. A distributed denial-of-service (DDoS) attack is a malicious attempt to disrupt normal traffic to a web property. Learn about DDoS attacks and DDoS. The most common method for such attacks is to flood your address with server requests, overloading and disabling your system with traffic. A DDoS (distributed. In a DoS or DDoS attack, an attacker floods the IP address of the targeted device (such as a console or a computer) with superfluous communication requests. u do, they will not listen. Try having a good time if u enjoy the game or As Bangalore fought people, the enemy players seemed to freeze up and not. This script is designed for educational purposes only and allows users to simulate a DDoS attack. Please note that hacking is illegal and this script should not. Recruit a number of computers using a virus or similar, getting them to install your DDoS program. You will also need to set up a control. What is a DDoS attack? A distributed-denial-of-service (DDoS) attack is the bombardment of simultaneous data requests to a central server. A denial-of-service (DoS) attack is a tactic for overloading a machine or network to make it unavailable. A DDoS, or "distributed denial-of-service," attack is a type of cyber attack that aims to overwhelm a targeted system with a flood of traffic. The attacker. A distributed denial-of-service (DDoS) attack is a malicious attempt to disrupt normal traffic to a web property. Learn about DDoS attacks and DDoS. The most common method for such attacks is to flood your address with server requests, overloading and disabling your system with traffic. A DDoS (distributed. In a DoS or DDoS attack, an attacker floods the IP address of the targeted device (such as a console or a computer) with superfluous communication requests.

Why would someone carry out a DDoS attack? There are many motives for DDoS attacks, ranging from disruption of services to espionage and cyber warfare. Some. A DDoS attack overwhelms the network's pipe, (the bandwidth) or the devices that provide that bandwidth. Here's a useful analogy: Imagine that several people. Identifying DDoS attacks · One or several specific IP addresses make many consecutive requests over a short period. · A surge in traffic comes from users with. A DDOS attack is defined as a type of cyber attack where multiple attackers distribute malicious activities across different locations to overwhelm a system. DDoS attack tools are used by attackers to exploit vulnerable networks, systems, and applications, usually for financial gain or political motivation. They can. Multiple Sources: DDoS attacks originate from many different sources, often from a geographically dispersed botnet. This distribution makes it hard to block. Examination of logs during a DDoS attack may reveal huge traffic spikes from countries that do not usually visit the website. Geo-blocking can block large. Make copies of any communication sent to you by the attackers. Sometimes, DDoS attacks are an attempt to blackmail or threaten a company or site owner. In these. A DDOS attack is defined as a type of cyber attack where multiple attackers distribute malicious activities across different locations to overwhelm a system. These attacks may render a device temporarily unable to connect to the internet. You can learn more about what to do in the case of a DoS or DDoS attack below. A Distributed Denial of Service (DDoS) attack is a massive assault on a system to degrade its performance. The attacker hopes to make it unavailable to its. If you conduct a DDoS attack, or make, supply or obtain stresser or booter services, you could receive a prison sentence, a fine or both. DDoS (Distributed Denial of Service) is a category of malicious cyber-attacks that hackers or cybercriminals employ in order to make an online service, network. A distributed denial of service (DDoS) attack is a form of DoS attack that originates from more than one source. DDoS attacks are typically more effective than. These DDoS botnets are networks of malware-infected computers exploited to make a victim server or network resource unavailable by overloading the device with. DDoS – An attack on the server, or network, from multiple PCs/devices that overloads the network. This results in all players being disconnected and the match. What is a DDoS attack? A distributed-denial-of-service (DDoS) attack is the bombardment of simultaneous data requests to a central server. Make copies of any communication sent to you by the attackers. Sometimes, DDoS attacks are an attempt to blackmail or threaten a company or site owner. In these. Identifying DDoS attacks · One or several specific IP addresses make many consecutive requests over a short period. · A surge in traffic comes from users with.